Helping businesses access the capital they need without any of the hurdles.

Up to 70% of businesses in emerging markets lack reliable access to capital. CreditBook fills the gap with simple, accessible financial solutions.

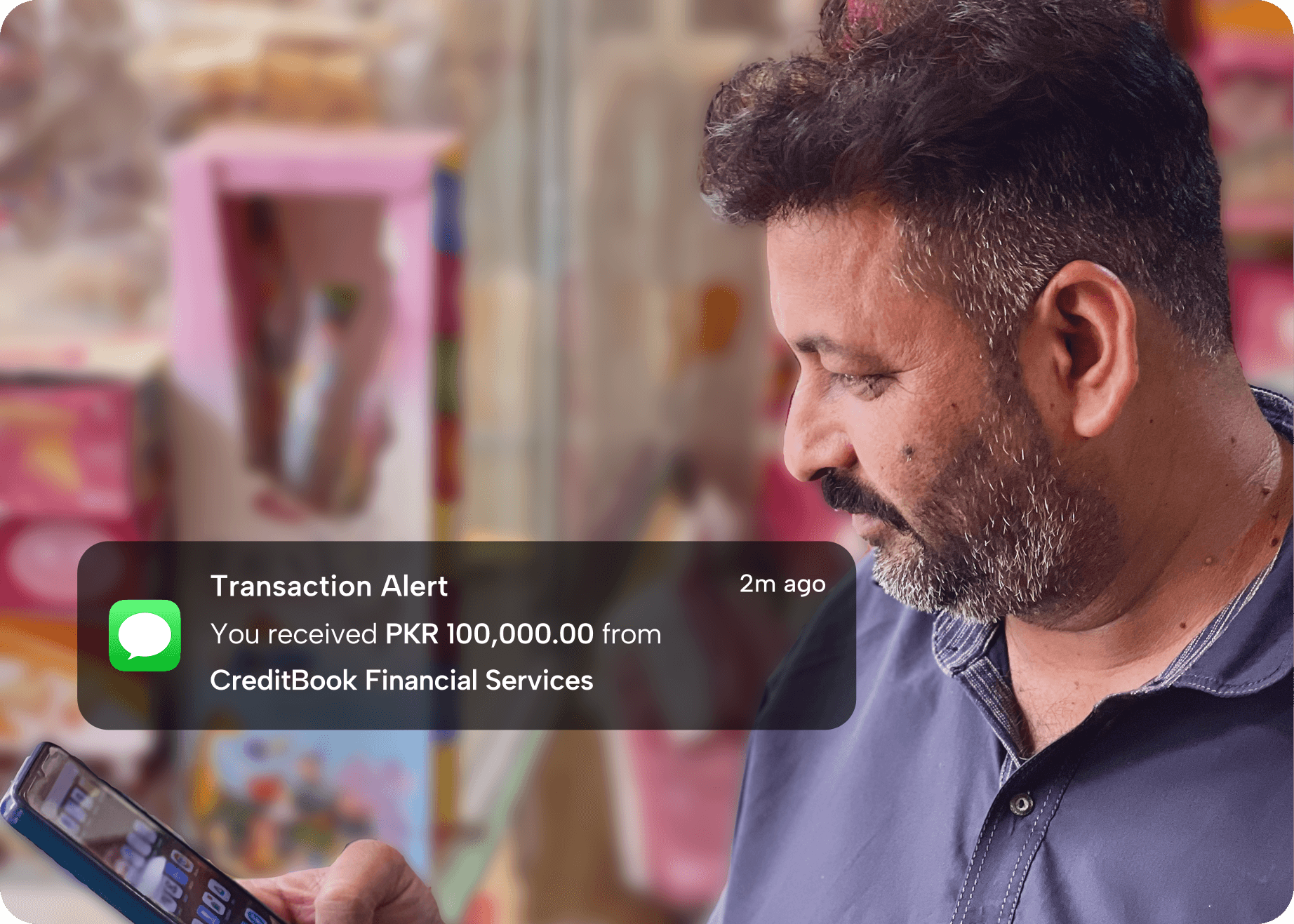

From Application to Your Bank Account in Under 48 Hours

CreditBook's simplified application

process skips the complicated paperwork and guarantees funds in your account in just 2 days.*

*After verification of your profile.

Instant access

We deposit funds directly into our account, ensuring you and your customers can access the funds you need within 48 hours.Tailored to your needs

We provide flexible financial products that can adapt to the unique needs of any business model and industry.Easy to use

Our user-friendly interface ensures a smooth, hassle-free experience where every action is easy to complete.Smart processing

Our system applies intelligent risk-scoring and compliance checks, providing a streamlined process that saves you time.Financial Solutions

From securing financing for yourself, to offering it to your customers - our comprehensive range of solutions are designed to support the way you operate.

Direct Lending Solution

Avail access to instant direct financing through Creditbook's dedicated financing portal, FinanceNow.

Embedded Financing

Our customizable APIs and SDKs allow you to embed financial services with financial control and flexibility.

Financial Management Software

Provides full visibility and control over compliance, credit rating, and financial transactions.

Our Impact

500K+

Businesses impacted

6B+

PKR disbursed till date

<12hrs

application to disbursement

<48hrs

to get started

BACKED BY